Turkish Finance Minister Berat Albayrak, the son-in-law of President Recep Tayyip Erdogan, unexpectedly resigned on Sunday, throwing the government’s management of the economy into further confusion after the central bank chief was fired on Saturday following a crash in the lira.

Albayrak, 42, cited health reasons for his decision to step down from his role as the government’s economy czar, according to a statement posted on his verified Instagram account.

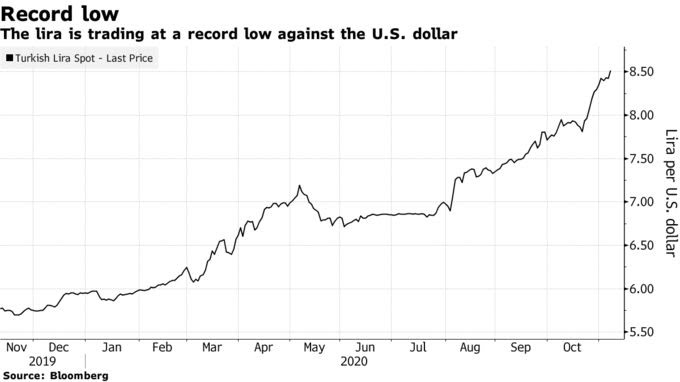

The minister’s resignation follows Erdogan’s abrupt decision to sack central bank Governor Murat Uysal and appoint 52-year-old former Finance Minister Naci Agbal to the post. Agbal is known for his opposition to Albayrak’s policies over the last two years, a period when the lira lost nearly half of its value against the dollar.

The Turkish currency has lost about 30% against the dollar in 2020, a decline that has accelerated since the central bank held back from an outright increase in the cost of borrowing at its October meeting.

A spokesman at the ministry confirmed the authenticity of Albayrak’s Instagram announcement to Bloomberg, asking not to be named in line with government policy.

But the fashion of the resignation caused turmoil itself, surprising even some of Albayrak’s own aides, who said the minister’s phone was off when they tried to reach him. Albayrak also appeared to have deleted his Twitter account on Sunday, and messages from a fake account denying the resignation were widely distributed.

‘Health Reasons’

“I decided not to continue my duty as a minister after five years in office due to health reasons,” Albayrak said in the statement. “I’ll spend my time with my mother, father, wife and kids, whom I have neglected for many years out of necessity.”

Albayrak served as the minister of energy until he took over the government’s top economy position in 2018. He’s been married to Erdogan’s daughter Esra since 2004

During Albayrak’s two-year stint as finance minister, inflation usually hovered in double digits, compared with the government’s official target of 5%. Turkey’s state lenders unsuccessfully tried to support the lira with unannounced interventions in foreign-exchange markets, where they are estimated to have sold tens of billions of dollars.

Before his sudden removal, Uysal had been raising borrowing costs through a mix of interest-rate increases and back-door measures since August, but it wasn’t enough to boost the currency, rein in inflation, or satifsy investors in Turkish assets.

The leadership change may not stem the lira’s losses unless monetary policy takes a more hawkish turn, according to economists. The country is running a current-account deficit and foreign-currency reserves are being eroded.

“The lira likely has more to fall,” said Hasnain Malik, the Dubai-based head of equity strategy at Tellimer, an emerging-market research firm. “Although policy credibility is very low, which means the currency keeps falling, the one comfort for investors is that we may be nearing the end of unjustifiably loose policy.”

Joe Biden’s victory in the U.S. presidential election is unlikely to do the lira any favors either. Traders have been concerned that U.S.-Turkish relations will suffer under the new administration. Turkey faces possible U.S. sanctions over the purchase of a Russian missile system, which was opposed by the U.S. and other NATO allies.

The appointment is unlikely to alter trends in the currency, inflation and reserves if it’s “not followed by significant changes in policy,” Goldman Sachs Group Inc. economists Murat Unur and Clemens Grafe said in a report.

Add Comment